56% of Americans can’t cover a $1,000 emergency with their savings. Taking advantage of high-interest savings accounts can help you grow your emergency fund faster.

Financial experts say that everyone should have between 3–6 months of savings in order to offset emergencies or to prevent accumulating high-interest debt such as credit cards. An emergency fund is a form of financial self-care that is critical for a person’s overall financial wellness. Despite the importance of an emergency fund, more than half of Americans have less than $1,000 in savings. If you are one of those people without much savings, check out this article outlining five simple steps to build an emergency fund. Americans should take this opportunity to leverage rising interest rates to help catapult their emergency fund to the next level.

Three years ago, I had to use my entire emergency fund to pay bills while I was between jobs. I secured a new job about 16 months ago and started rebuilding my emergency fund by using these strategies. First, I calculated my monthly minimum expenses, which total approximately $4K/month. Next, I set a goal of wanting six months of savings (6 months x $4K = $24K). I assessed my budget and decided that I could consistently allocate ~5% of my take-home pay ($218.75/paycheck) to rebuild the fund. Next, I automated.

Automation

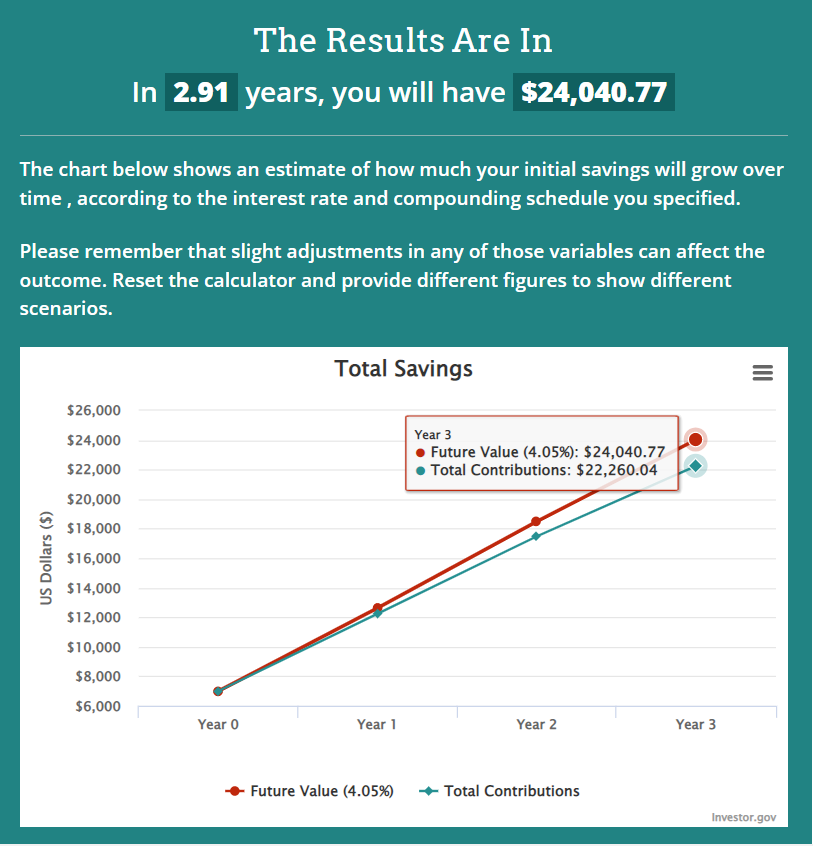

To help ensure that I don’t touch those funds, I reorganized my direct deposit into separate bank accounts. 95% of my paycheck goes into my regular checking account at my normal bank. I have a debit card for that checking account, and the bank has a brick-and-mortar location that I can access at any time if I need to. The other 5% of my take-home paycheck was transferred to an online savings account, which differs from my regular bank account. That way, 5% of my money was automatically transferred to an account that was harder to access and less visible (out of sight, out of mind). Within 16 months, the online bank account holding my emergency funds had grown to $7,000! But unfortunately, I was only earning .05% interest. If I maintained this schedule of contributing $218.75 per paycheck, earning .05% interest, it would take me three years and three months to reach my goal of $24,000.

Rising Interest Rates are a Game Changer

With the rising of the federal interest rates, I realized that I could help grow my funds faster. So I transferred my savings to Wealthfront, which currently offers 4.05% for savings accounts, plus an additional .50% for the first six months of a new account if using a referral code. Basically, people can earn 4.55% on their savings for a limited amount of time. This is an incredible offer in an era when banks have paid rates of less than 1%.

Wealthfront has paid me $15.46 in interest in the first 19 days of transferring money into the account!

If I don’t add more money to this emergency fund, I’ll earn $250 in interest by the end of the first year. If I continue to add at my regular rate, I’ll have $12,631.27 in my account by the end of the year, of which $387.27 would be earnings from interest. If I maintain this schedule of contributing $218.75 per paycheck, earning 4.05% interest, I will reach my goal in 2 years and 11 months, four months faster than if I had kept the money in my previous account!! Leveraging higher interest rates is a true game changer. I reach my goals faster without having to increase the amount of money I save each month.

Remember, part of generating wealth is allowing your money to work for you. Most people stay at the bottom level of the wealth pyramid because they don’t find a way for their money to work for them. Don’t be one of those people.

“If you don’t find a way to make money while you sleep, you will work until you die.” — Warren Buffett

This story contains an affiliate link to Wealthfront’s promotional 4.55% offer

If you enjoy reading content like this, consider subscribing to my feed. Also, if you are not a Medium member and would like unlimited access to the platform, consider using my referral link right here to sign up. It’s $5 a month, and you get unlimited access to my articles and many others like mine. Thanks.

*Note: I’m not a financial advisor; I write for educational/entertainment purposes only. Nothing in this or any of my other articles constitutes financial or legal advice.