In 2021, I made over $150K in crypto profits. I plan to make triple that in the next couple of years! Here is a part of my strategy where I plan to turn $3,600 into $20,000.

Currently, we are in a bear cycle, which means this is a special time for laying the groundwork to get rich.

Prices go in cycles, and the next bull cycle is coming soon.

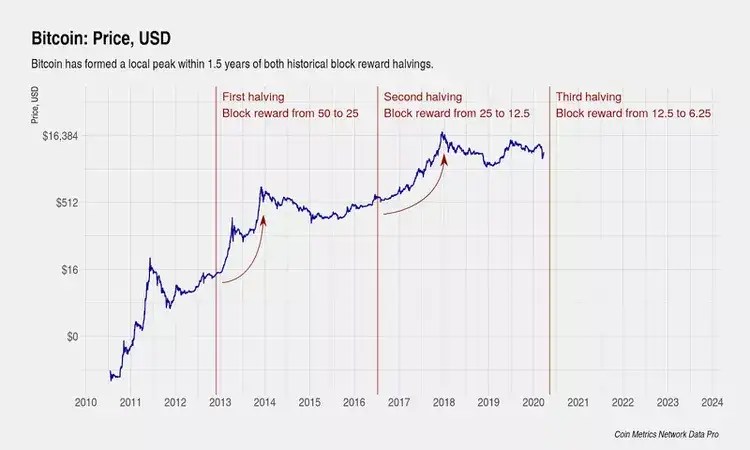

Crypto prices go in cycles that are primarily driven by the Bitcoin halving. Bitcoin halvings occur roughly every four years. After Bitcoin miners mine 210,000 blocks on the blockchain, the rewards that miners earn is cut in half, thereby halving the rate at which new Bitcoins are released into circulation. Since its founding in 2008, there have been three Bitcoin halvings, the first in 2012, the second in 2016, and the last in 2020. Halvings are Bitcoin’s way of enforcing synthetic price inflation until all coins are circulated. The three previous halvings have correlated with intense boom and bust cycles ending with higher Bitcoin prices than before the halving event.

Coinwarz estimates that the next halving will happen in mid-March 2024. The all-time high generally occurs between 12 to 18 months after the halving date. After the first halving in 2013, Bitcoin peaked at around $850 in February 2014. After the second halving in 2017, Bitcoin peaked in Jan 2018, reaching $17,000. After the last halving in 2020, Bitcoin’s price hit $65,000 in November 2023. If the next halving is in March 2024, the historical trend suggests that the next all-time high will be sometime between March and September 2025.

In 2025 we could see Bitcoin’s price hit $100,000 per coin or more.

Bitcoin’s Price Drives the Entire Crypto Market

We know that Bitcoin is the bellwether for the entire crypto market. If Bitcoin’s price increases, altcoins follow, usually at exponentially better rates. For example, if Bitcoin triples its previous all-time high, then altcoins (such as Ethereum) can hit 4, 5, or 6 times greater return than its previous cycle’s all-time high. Similarly, smaller altcoins (such as Cardano) can have 10–20 times the return. The real money in crypto is made when people invest in altcoins. For example, in 2021, I made 30 times my investment on one altcoin (Polygon), turning $115 into $3,500 passively.

The profits from my small alt-coin investment equaled more than some people’s monthly salary.

Experienced crypto investors use the bear cycles (the time before and immediately after the halving) to accumulate as much Bitcoin and as many altcoins as possible so that they can take profits when the all-time high prices occur after the halving. Therefore, now is the time to accumulate as aggressively as possible so that you have laid the groundwork for getting rich in 2025.

Because now is the time to take action, I am using 2023 to accumulate coins that I think will do well in 2025. I have a multi-layered strategy but here is one part of it.

My investment plan for 2023

Before investing, there were three essential steps that I took. Those steps included researching, setting a budget, and starting to dollar cost average every week.

Before investing, there were three essential steps that I took. Those steps included researching, setting a budget, and starting to dollar cost average every week.

Step 1: Research 4–7 coins that I wanted to invest in

- I settled on Bitcoin, Ethereum, Solana, Polygon, Avalanche, and Cardono.

- These are not the only coins I’m investing in, but they represent a large part of the portfolio that I’m building.

Step 2: Determine what I could easily afford to invest every week without regret

- I could comfortably afford to invest $60 per week. This $50 is extra money in my budget. These dollars are not coming from my mortgage, not coming from my grocery budget, nor impeding my ability to put gas in my car. They are truly extra funds.

- It is important to only invest what you can easily afford and are also willing to lose. If the crypto market tanks and never rebounds, I would not be happy, but I would be ok losing these funds.

Step 3: Start dollar-cost-average (DCA)into those coins weekly

- Weekly investments are better than monthly investments because of how quickly prices change in crypto. Unlike stocks, the price of a coin could shift by 10% or more within 24 hours. So the average price per coin is much better when you DCA weekly.

- I spread this $60/weekly investment over the selected coins. My allocation looks like $14 on Bitcoin, $21 on Ethereum, $8 on Solana, $3 on Polygon, $7 on Avalanche, and $7 on Cardano.

What kind of profits do I anticipate in 2025?

I’ve been using the above strategy since the start of 2023; I will continue implementing it through March 2025 (a combined total of 60 weeks). Over the course of these 60 weeks, I’ll have invested a total of $3,600. I fully anticipate that in 2025 my $3,600 investment will multiply by 4 to 6 times, conservatively. I have the potential to earn a profit of $12K to $20K. Here is the breakdown:

What do you think? Do you think I’ll make it? I plan to revisit this article in mid-2025 to see how my predictions measure up. What are your plans for getting rich in the next crypto bull cycle?

*Note: I’m not a financial advisor; I write for educational/entertainment purposes only. Nothing in this or any of my other articles constitutes financial or legal advice. This article was previously published on www.G-Wallace.com