Having a 3-to-6 month emergency fund is important for overall financial health, but most Americans have a severely underfunded emergency fund. Fool.com reports that the average American has $3,500 in savings and only a $2,000 emergency fund. This is especially troubling when the average American household has $5,111 in monthly expenses.

Emergency fund = “shock absorber”

Having a healthy emergency fund is critical given these uncertain times. Not only are we living in the wake of a global pandemic, but we are also experiencing dramatic stock valuations, threats of recession, and soaring inflation. In addition to the macro-economic uncertainty, any one of us could individually encounter unexpected unemployment, sudden illness, and major car or home repairs. Any of the aforementioned could set a person’s financial health back by years or decades depending on the severity. Investopedia says to think of the emergency fund “as a shock absorber for the bumps of life, one that’ll keep you from adding to the load of debt you most likely already carry.”

Most Americans are woefully underprepared for an emergency.

Below are 5 simple steps you can use to build your emergency fund. Here, you can find a free emergency fund budgeting tool.

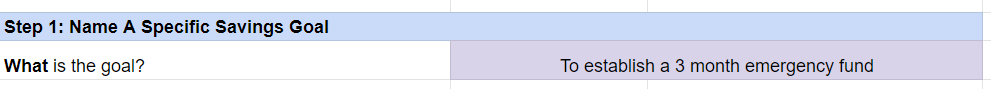

Step 1: Name A Specific Savings Goal

Too often, people pick a random number that sounds nice as a savings goal. They fail to have a well-reasoned number that was identified for a specific purpose. I have seen scenarios where people say things like “I want $10,000 in savings” but do not have a specific purpose or rationale for that $10K. Without specificity, it becomes very easy to think of those funds as available for discretionary purposes. The first step is to have a specific savings goal. In this case, let’s use the goal of establishing a 3-month emergency fund.

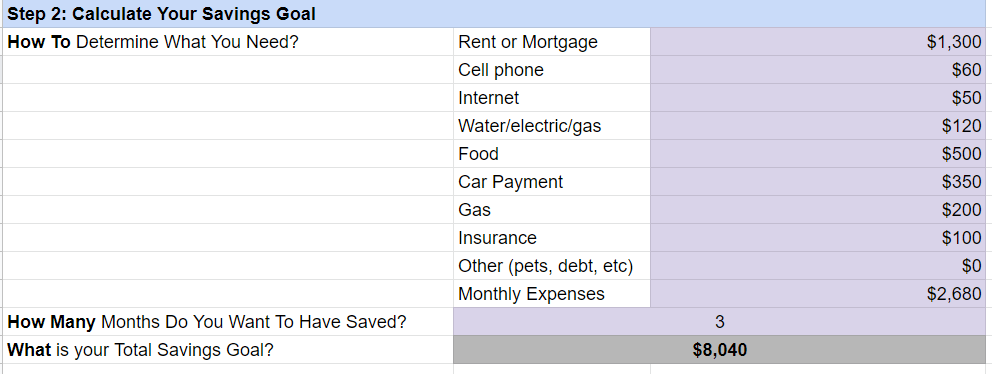

Step 2: Calculate Your Savings Goal

We need a specific dollar amount to work towards. That dollar amount should be the total of your real-life necessary expenses. When calculating necessary expenses, do not include luxuries or discretionary items that you would cut from your budget in the case of an emergency. For example, your emergency fund should include your monthly grocery bill but not the amount you spend dining out. Once you have your monthly total, multiply that by the number of months you want to have in your emergency fund. Here is an example:

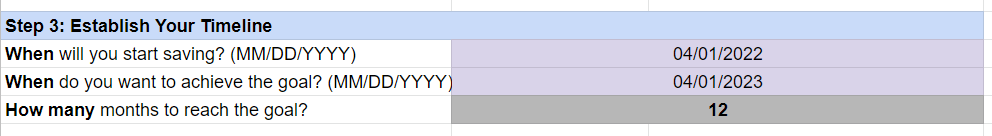

Step 3: Establish the Timeline

After settling on the goal, now determine your timeline for reaching the goal. Using our example, let’s say we want to give ourselves one year to reach our goal of a 3-month emergency fund. At this step, it is important to have a specific start and end date. These dates should be realistic and based on your actual ability.

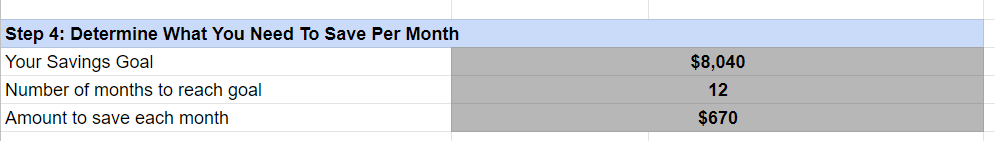

Step 4: Determine What You Need to Save Per Month

After determining your timeline, divide the total amount you want to save by the number of months you’ve given yourself to achieve the goal. This will give you the amount you need to save per month. This step is important because it breaks a large goal into manageable parts. It also helps you to stay accountable for the timeline you created in step 3.

Step 5: Determine the Feasibility of the Plan

Evaluate your monthly savings number to determine if that amount is easily within your current monthly budget. In the example, if saving $670 a month is out of reach, then this person would want to extend their timeline so that they are establishing an achievable plan. It is important that we set an achievable monthly goal to ensure we reach our large goal. If the monthly savings amount is too low, then this person might consider shortening their timeline so that they can reach their emergency fund goal sooner.

If the answer in step 5 is yes, then you are ready to jump into action. You can set up a separate bank account, auto-pay, and begin working towards your savings goal. Optimal success comes after planning.

Conclusion:

Once you follow the five steps to reach your emergency fund goals, you should think of it as an insurance policy, not a piggy bank. Do not use it for incidental expenses such as vacations or new furniture. Use the funds only in the event of an actual emergency. The healthier your emergency fund is, the better you will be able to weather the natural bumps of life. Get your free budgeting tool to help build your emergency fund here.

To your prosperity,

— Genietha

*Note: I’m not a financial advisor; I only write for educational/entertainment purposes. Nothing in this or any of my other articles constitutes financial or legal advice.